Key Copper & Gold Market Insights

Copper: A Strategic Metal for the Energy Transition

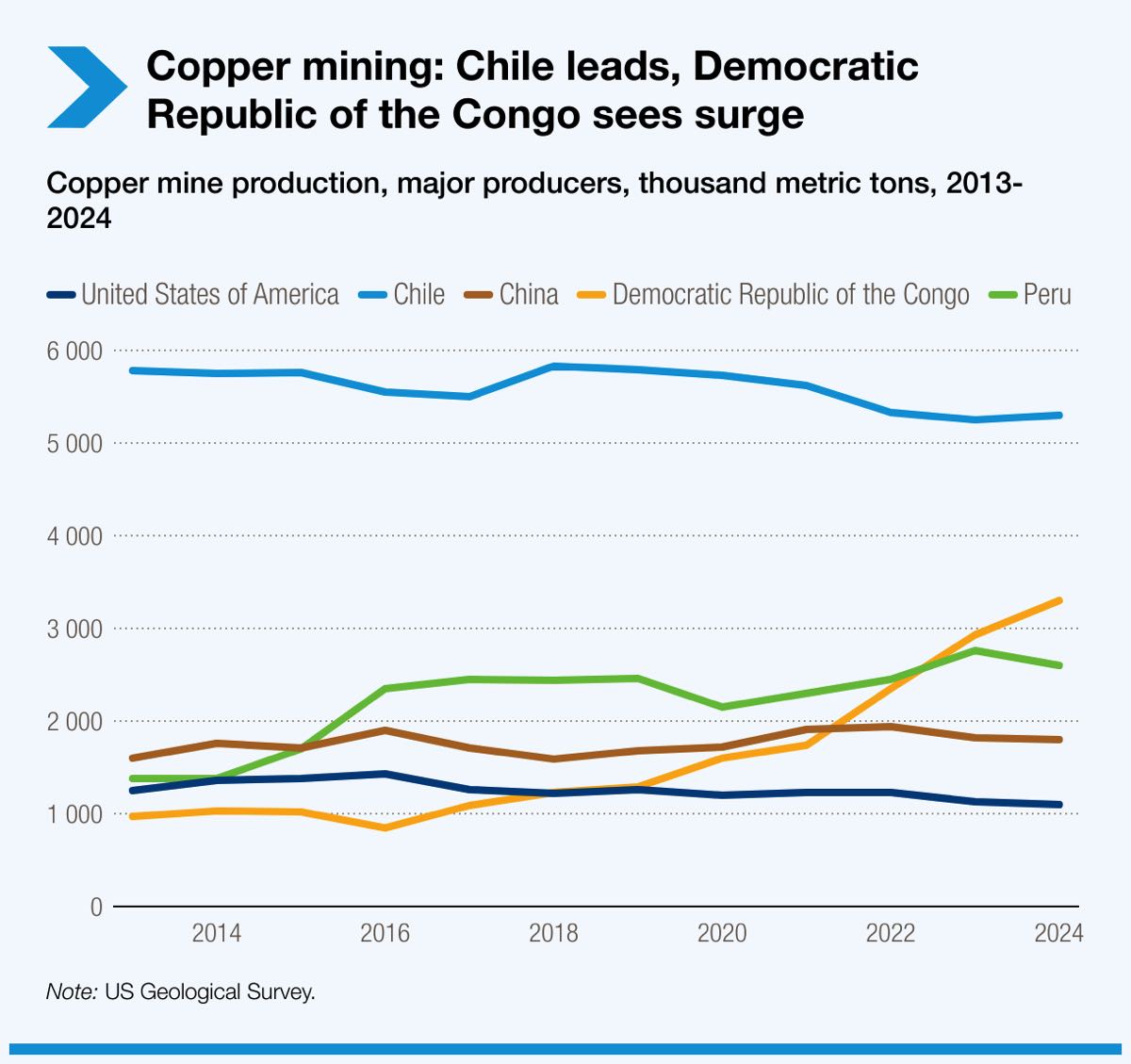

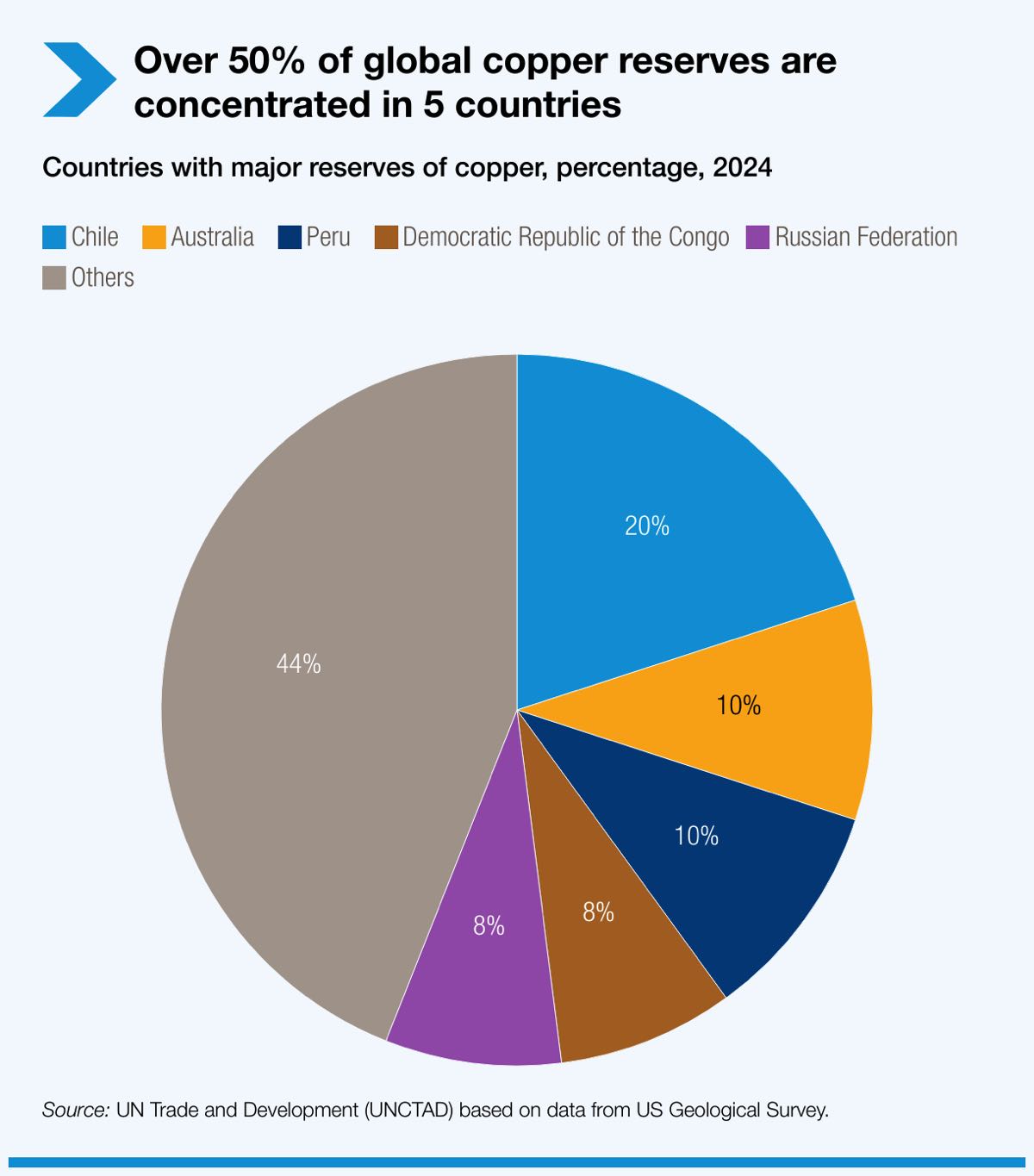

Global copper demand is forecast to grow by more than 40% by 2040, driven by electrification, decarbonisation and rapid digitalisation. However, supply is not keeping pace. Meeting projected demand could require the development of up to 80 new copper mines and an estimated US$250 billion in investment by 2030.

Copper has emerged as a strategic raw material at the centre of the global energy transition and digital transformation. It is essential for electric vehicles, renewable energy generation and storage, data centres, AI infrastructure, and smart electricity grids.

Against this backdrop, the challenge is clear: new discoveries and timely development of copper resources are critical to securing future supply. Companies with the technical capability, geological expertise and strategic focus to identify new copper systems are increasingly important to the global supply chain.

Taruga is well positioned to contribute to this next generation of copper discoveries, targeting underexplored and highly prospective geological terrains with the potential to deliver meaningful new copper resources as demand accelerates.

Gold: Strategic Value Meets Strong Market Momentum

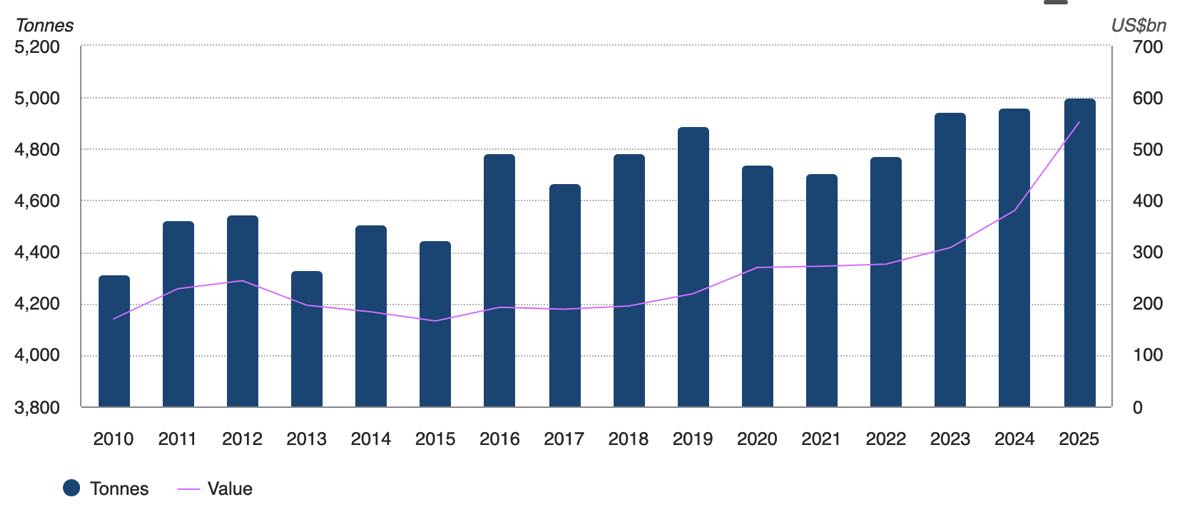

Gold continues to demonstrate its enduring role as a store of value and a strategic commodity in an uncertain global economy. In 2025, total global gold demand exceeded 5,000 metric tons for the first time on record, generating an unprecedented US$555 billion in total demand value — a 45% increase year-on-year — as prices repeatedly hit new all-time highs.

Global annual gold demand breaches 5,000t and US$500bn

Annual gold demand in tonnes and US$bn*

Investor demand has been a key driver of this growth, with inflows into gold exchange-traded funds (ETFs) and purchases of physical bars and coins reaching multi-year peaks. Central banks also remained significant buyers, collectively adding hundreds of tonnes to reserves during 2025.

This strong demand environment has coincided with a record-breaking price rally. In late January 2026, gold prices surged past US $5,500 per ounce, driven by geopolitical tensions, economic uncertainty, and ongoing investor interest in safe-haven assets. Major financial institutions project continued strength in gold prices into 2026 and beyond, with forecasts seeing average prices well above historical norms.

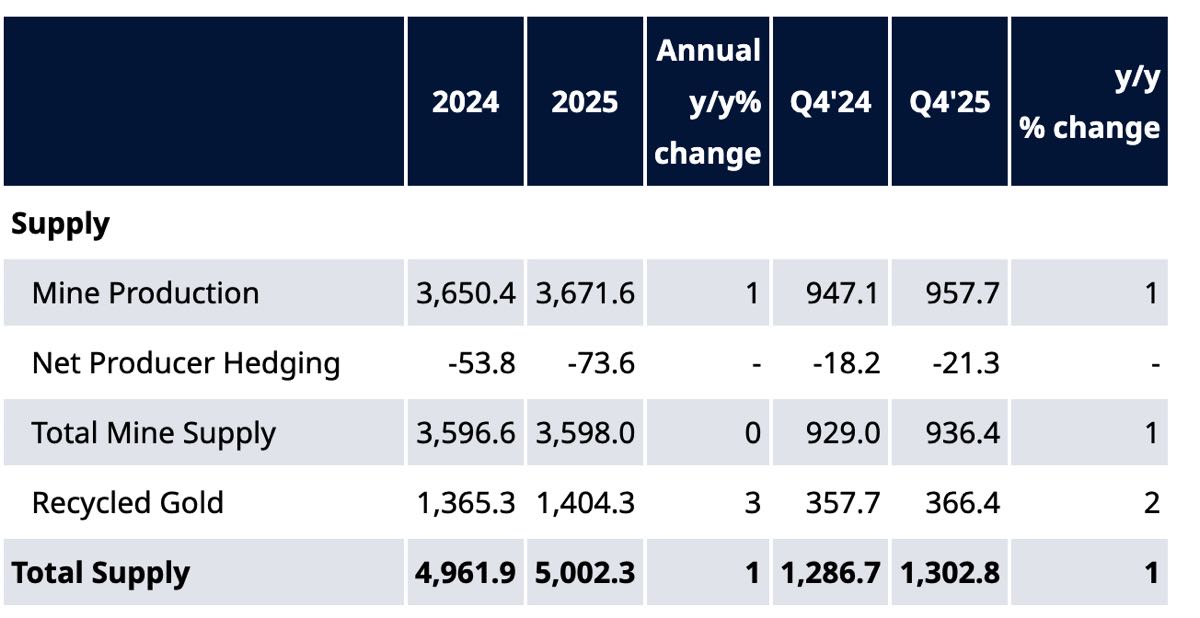

Despite elevated prices, supply growth has been modest, with global gold mine production increasing only incrementally and recycling activity relatively flat compared with booming demand.

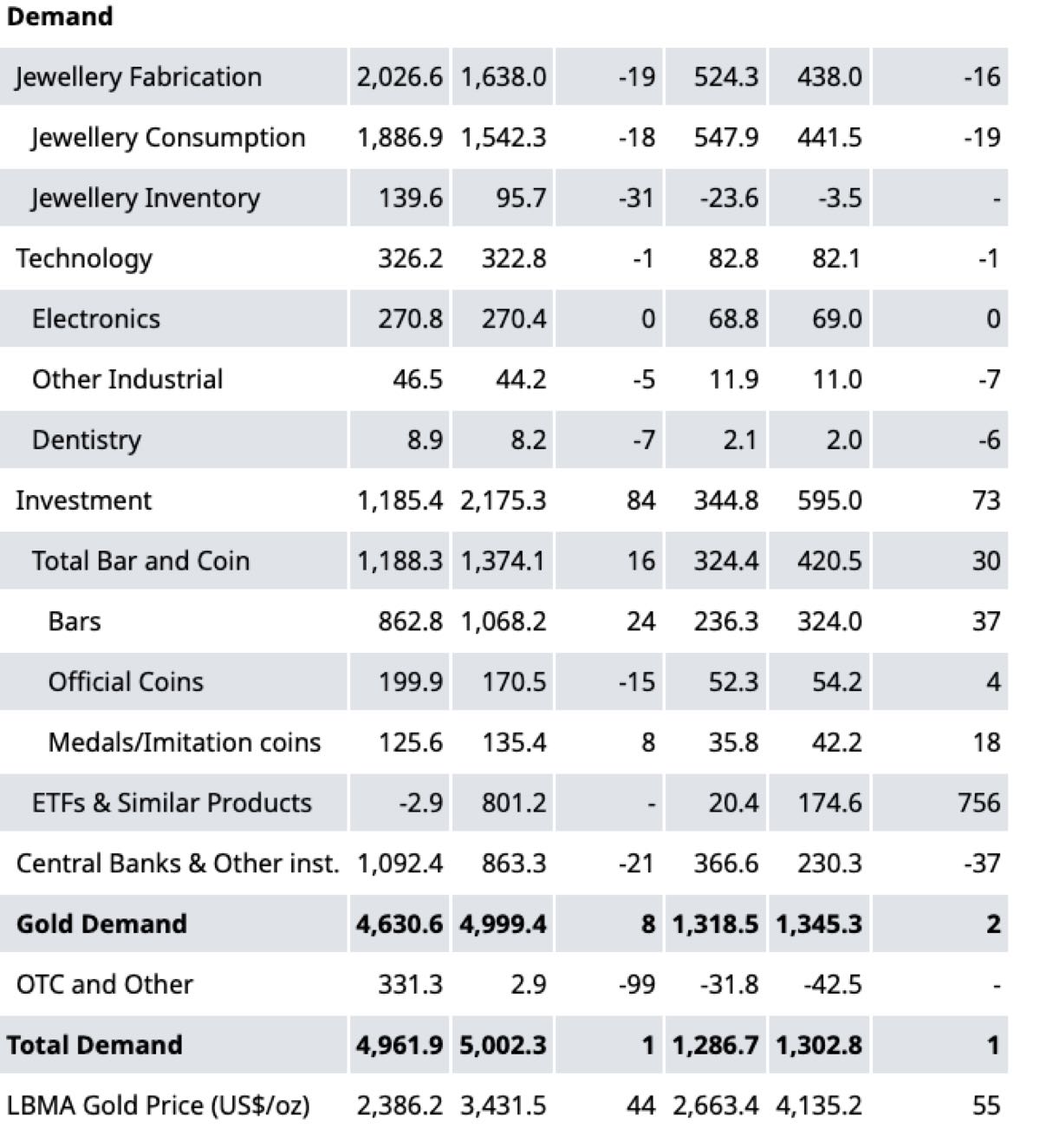

Gold supply and demand

Gold supply and demand by sector, tonnes

In this higher price, strong demand environment, the ability to make new discoveries and to delineate high-quality gold resources becomes even more valuable:

- Record demand and elevated prices underscore the economic incentive to find and develop new gold deposits.

- Supply growth constraints highlight the need for fresh discoveries as existing mines mature.

- Taruga’s disciplined exploration strategy and technical expertise place it in a strong position to identify and advance prospective gold systems that can deliver value in this dynamic market.

Taruga is strategically positioned to capitalise on these market tailwinds, combining geological insight with exploration focus to pursue impactful discoveries in a market where demand and pricing fundamentals remain robust.

Copper source: UN Trade and Development https://unctad.org/publication/global-trade-update-may-2025-critical-minerals-copper

Gold source: World Gold Council https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-full-year-2025